Still for a lot of people in India, stock market is an alien subject or a segment that should be avoided for the fear of risks associated.

It can actually be a great savings option at Investor fingertips with control over the capital at any point of time but only when Investor is at profitable position.

The best part of being in Stock Market is it’s fluidity. Years of study in Stock Market has brought many technical indicators to study market or stock movement. But market always throws surprises, or rather it is influenced by global and local events. And what happens in future is unpredictable, so is stock market. But it is still worth a try.

So, technically what should a person do to become an investor, there are so many stock trading platforms called stock brokers today which are very user friendly and facilitates trading/Investing with a minimal user charge, investor can register with any popular Stock Broker. Reputed Stock Brokers work under SEBI guidelines, so are trusted.

Registering needs a bank account which can be converted to Demat by the stock broker itself, few proofs AADHAAR or PAN, bank statement or cancelled cheque and your signature which can be recorded through the video, all the formalities will be done in a couple of days, all through online.

Any person can start their investing journey through these simple steps.

To know more about stock markets refer What is Stock Market explained for a beginner

Stockbrokers provide an easy interface through which investors can do transactions.

Brief outline about the interface provided by stock broker

- There will be provision to add money, through which investor can buy selected business shares.

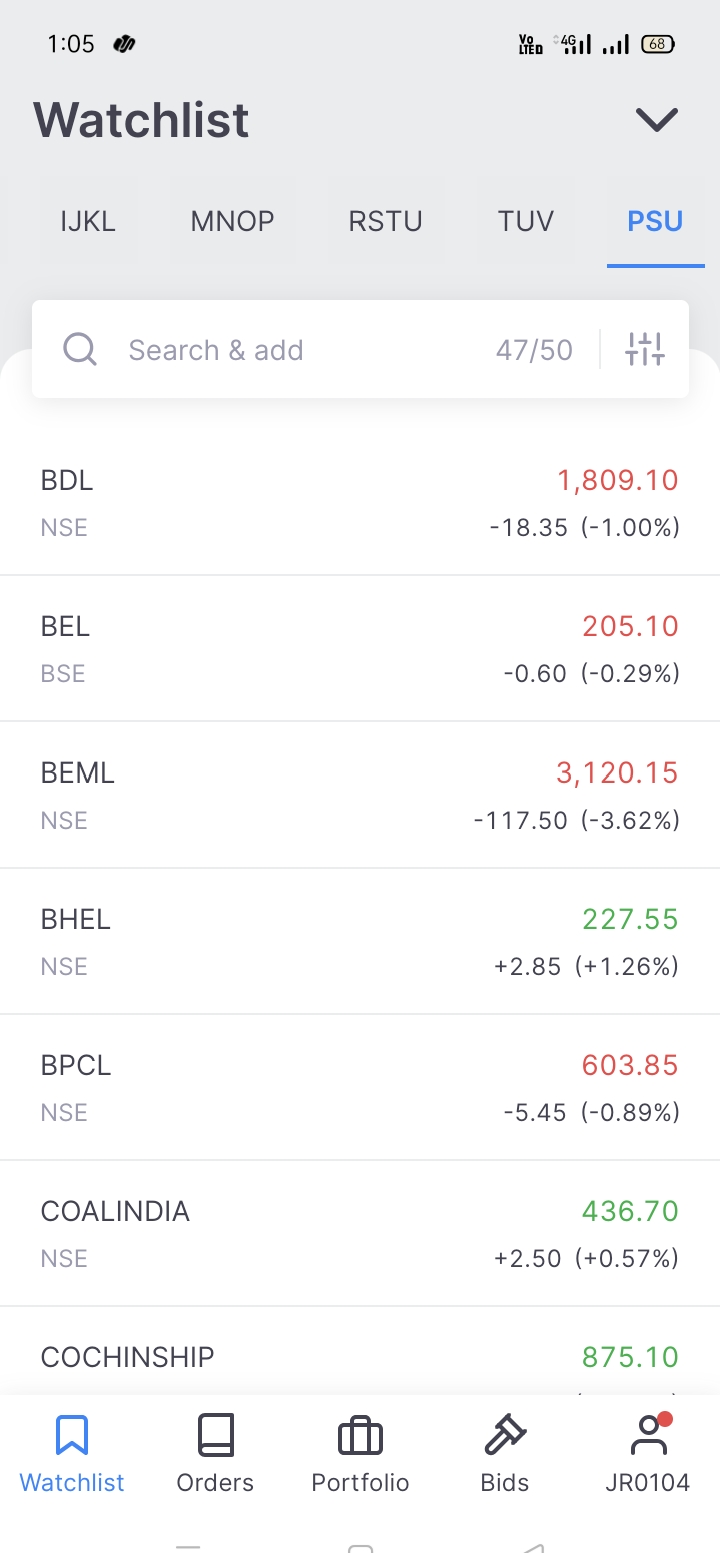

- There will be space called watchlist, where investor can keep track of companies, with market value of the share displayed as shown in below image.

- In the above image, red colour shows the demand for that particular stock is low that day and it is traded at less price than the previous day, similar green implies demand is high and price has increased.

- And there will be option to check price movement of a particular stock for day, week, month, year, 5 years and lifetime through graphs for each business.

- The stocks, investor bought will reside in portfolio section, if stocks are bought on that day they will be in position section, which moves to portfolio section on next day.

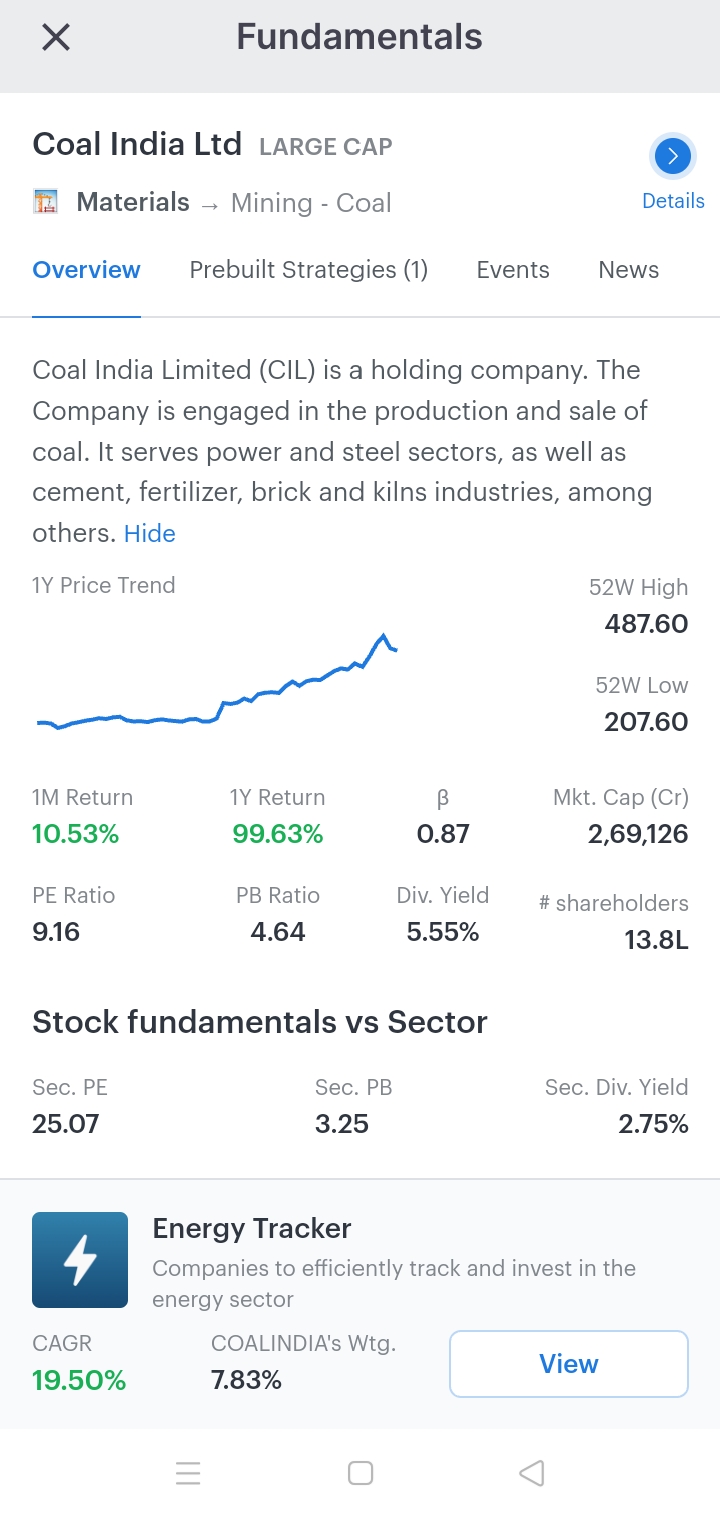

- Below image shows brief summary about the stock overall movement in 52 weeks, the high price in 52 week(487), low price(207) and various parameters which can be useful to get an understanding about the worth of the stock.

-

- An investor who bought few shares in a particular company sells them when he achieved his desired profit, it can happen in days, months or years.

- A view statement option shows all the transactions done by the user and the transaction charges collected by the broker.

There will be many more options which can be discussed in another section in detail. The idea of this post is to give a brief introduction to the world of stock market and investor.

Any queries or topics that needs attention feel free to comment.

Disclaimer

Markets are subject to market risks.Stockvedam don’t advise or endorse any stock. Stock Market investment should be done with investor discretion. Stockvedam is not responsible for any losses incurred by the investor.The content at www.stockvedam.com is for informative purpose. Investor should do his own research while investing in stocks.

Leave a Reply